Liquide Market Summary 14th January 2026

The Indian markets closed lower on January 14, amid a volatile and rangebound session. Investors adopted a cautious stance ahead of the US Supreme Court's decision on the legality of President Donald Trump's tariff measures.

Indian Stock Market Today: The Indian markets closed lower on January 14, amid a volatile and rangebound session, as weakness in auto, IT and realty stocks weighed on the indices. Investors adopted a cautious stance ahead of the US Supreme Court's decision on the legality of President Donald Trump's tariff measures.

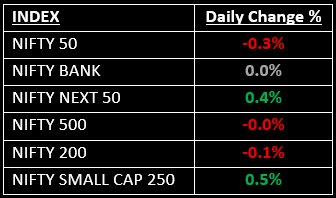

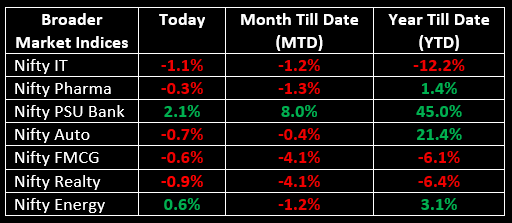

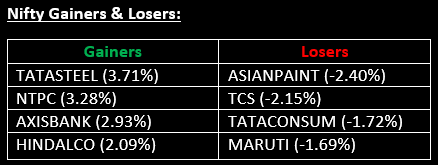

Broader market indices outperformed the benchmark, with BSE Midcap and Smallcap indices finishing in the green. On the sectoral front, Metal, PSU Bank and Energy indices rose by 0.6-2%, while Auto, IT and Realty sectors saw declines of 0.7-1%.

The market will remain closed on Thursday, January 15, due to municipal corporation elections in Maharashtra.

NIFTY: The index opened 83.75 points lower at 25,648.55, reached a high of 25,791.75 and closed at 25,665.60. On the daily chart, Nifty formed a small bullish candle with a long upper shadow, indicating narrow-range movement along with volatility. Its immediate resistance level is now placed at 25,800 while immediate support is at 25,600.

BANK NIFTY: The index opened 248.45 points lower at 59,330.35, reached a high of 59,796.65 and closed at 59,580.15. Bank Nifty formed a bullish candle with an upper shadow, indicating a positive trend despite pressure at higher levels. Its immediate resistance level is now placed at 59,800 while immediate support is around 59,300.

Stocks in News

- MRPL: Stock surged 9% after the company reported a massive 130% increase in net profit to ₹1,451 crore. EBITDA margin expanded by nearly 500 basis points, reaching 11.3%, up from 6.6% in the previous quarter.

- Puravankara: Stock zoomed 9% following the company’s Q3 business update, which revealed a 22% YoY jump in collections to ₹1,140 crore. Average realizations also increased by 12% YoY, reaching ₹9,500 per sq.ft.

- Union Bank of India: Stock jumped 8% after the bank reported a 9% YoY rise in Q3 profit to ₹5,017 crore. Additionally, net NPA fell by 31 bps to 0.51%.

Other News

- Asian markets ticked higher on Wednesday, led by Japan as optimism over potential fiscal stimulus and broader macro cues supported regional equities.

- European shares hit record highs, bouncing back from a modest dip the prior day as gains in utility and healthcare sectors offset weakness in media and defence stocks.

- Oil prices slipped after four days of gains as Venezuela resumed exports and U.S. crude and product inventories rose, though fears of supply disruptions due to civil unrest in Iran continued to linger.

- Gold climbed to a record high and Silver breached the $90 mark, as softer‑than‑expected U.S. inflation data reinforced bets on future interest rate cuts amid ongoing geopolitical uncertainty.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.