Liquide Market Summary 12th January 2026

Indian equity benchmarks ended the day in positive territory on January 12, breaking a five-day losing streak. The Nifty closed near 25,800, after staging an intraday recovery to settle near its day's high.

Indian Stock Market Today: Indian equity benchmarks ended the day in positive territory on January 12, breaking a five-day losing streak. The Nifty closed near 25,800, after staging an intraday recovery to settle near its day's high.

Despite positive global cues, domestic markets opened lower and extended losses, reaching an intraday low of 25,473.40 in the first half of the session.

However, a sharp recovery followed mid-session, sparked by US Ambassador Sergio Gor's comments on a potential India-US trade deal. Gor stated that both nations would continue to engage actively, with the next round of talks scheduled for the following day.

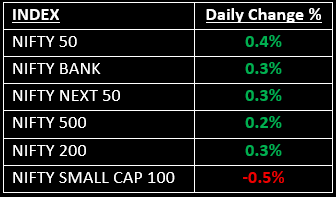

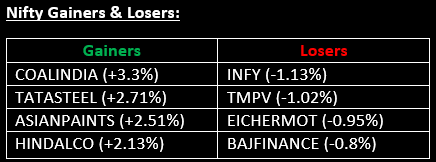

Broader indices, however, underperformed. The BSE Midcap index declined by 0.4%, while the BSE Smallcap index fell by 0.7%. Among sectors, Metal, PSU Banks, Financials and FMCG rose between 0.5% and 2%. In contrast, Pharma, Media and Realty saw declines ranging from 0.4% to 1.5%.

NIFTY: The index opened flat at 25,669.05, reached a high of 25,813.15 and closed at 25,790.25. On the daily chart, Nifty formed a bullish candle with a long lower shadow, indicating strong buying interest at lower levels. Its immediate resistance level is now placed at 25,860 while immediate support is at 25,750.

BANK NIFTY: The index 34.30 points lower at 59,217.25, reached a high of 59,541.10 and closed at 59,450.50. Bank Nifty also formed a bullish candle with a long lower shadow. Its immediate resistance level is now placed at 59,630 while immediate support is around 59,300.

Stocks in News

- Shakti Pumps: Stock jumped over 5% after the company secured a ₹654 crore contract from Karnataka Renewable Energy Development to supply off-grid DC solar photovoltaic water pumping systems.

- IREDA: Stock rose nearly 4% following a 38% jump in net profit, which reached ₹585.2 crore. Additionally, net interest income climbed 35% YoY to ₹897.2 crore.

- Hindustan Zinc: Stock gained nearly 4% as silver prices rebounded after a sharp decline earlier in the week. As India's largest producer of silver, the company benefited from the recovery in silver prices.

Other News

- Asian markets closed mostly higher on January 12, with positive sentiment driven by Wall Street’s gains from Friday and supportive global cues.

- European equities, however, dipped on Monday as tensions between the U.S. administration and Fed Chair Jerome Powell weighed on market sentiment. Additionally, President Donald Trump's proposal for a one-year cap on credit card interest rates negatively impacted bank stocks.

- Oil prices slipped on Monday after Iran claimed to have regained control following the largest anti-government protests in years, easing concerns about potential supply disruptions from the OPEC producer.

- Gold surged approximately 2%, reaching $4,600 per ounce, while Silver also set a new record. The surge in precious metals was largely attributed to the criminal probe by the Trump administration into Powell, prompting investors to flock back to safe-haven assets.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.