Liquide Market Summary 10th February 2026

Indian equity markets extended their winning streak for a third consecutive session on February 10, with the Nifty inching closer to 26,000 intraday, supported by broad-based sectoral buying and positive global cues.

Indian Stock Market Today: Indian equity markets extended their winning streak for a third consecutive session on February 10, with the Nifty inching closer to 26,000 intraday, supported by broad-based sectoral buying and positive global cues.

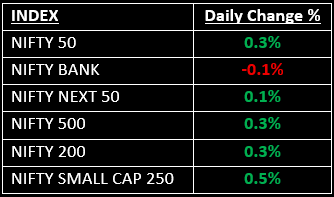

Broader markets outperformed the benchmarks, as the Nifty Midcap index advanced 0.5% and the Smallcap index gained 0.4%.

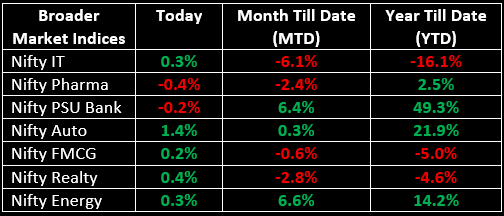

Sectoral performance remained largely positive, with all indices closing in the green except Pharma and PSU Bank. The Media index led the rally with a 2.4% rise, followed by the Auto index, which climbed 1.4%.

NIFTY: The index opened 55.35 points higher at 25,922.65, reached a high of 25,989.45 and closed at 25,935.15. On the daily chart, Nifty formed a Doji-like candle, indicating indecision between bulls and bears. Immediate resistance is placed at 26,000, while immediate support stands at 25,830.

BANK NIFTY: The index opened 71.45 points higher at 60,740.80, reached a high of 60,797.55 and closed at 60,626.40. Bank Nifty formed a small bearish candle, indicating consolidation and rangebound activity following the recent rally. Immediate resistance is placed at 60,800, with support around 60,400.

Stocks in News

- Lumax Industries: Stock hit the 20% upper circuit after robust Q3 results, with net profit rising 39% to ₹46.5 crore and revenue climbing 19% YoY to ₹1,052.7 crore.

- Tracxn Technologies: Stock surged nearly 13% after reports that ace investor Mukul Agrawal acquired 20 lakh shares of the company worth ₹6.6 crore at an average price of ₹33 per share.

- Wakefit Innovations: Stock climbed 8% after the company reported a net profit of ₹31.8 crore, compared to a net loss of ₹2.4 crore last year, while revenue increased 9% YoY to ₹421.3 crore.

Other News

- Asian equities traded broadly higher on Tuesday, with Japan’s benchmark hitting another record following the historic election victory of the nation’s first female prime minister.

- European markets delivered a mixed performance, as major indices posted modest gains or slight declines while investors digested corporate earnings and awaited key U.S. economic data.

- Oil prices edged lower as traders assessed the risk of supply disruptions after U.S. guidance for vessels transiting the Strait of Hormuz kept focus on tensions between Washington and Tehran.

- Gold prices softened amid improving risk appetite that supported global equities, while investors looked ahead to a slate of U.S. economic data that could influence the interest rate outlook.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.