India's WPI Inflation Turns Negative - A Storm or Silver Lining for Investors?

Explore the impact of deflation on the Indian economy and the potential consequences for stock market investors.

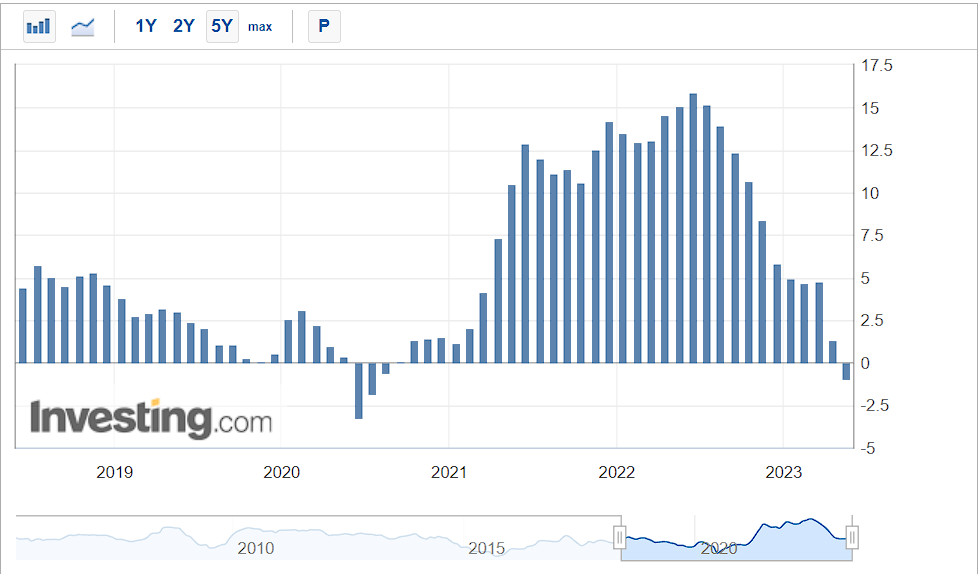

In the financial world, trends are everything. Over the past 11 months, wholesale price index (WPI) inflation in India has been following a downward trend that is impossible to ignore. In April, wholesale prices in India unexpectedly plunged into the negative territory to -0.92% - the first in nearly three years. A negative WPI inflation, known in economic circles as deflation, signifies a year-on-year fall in wholesale prices. This downturn was driven by a decrease in global commodity prices that lessened food, fuel, and other input costs for producers. The last time we saw such a level was in June 2020, when inflation hit -1.81%.

WPI India Statistics: A Closer Look

Just a month prior, in March, WPI inflation was at 1.34%. However, April brought a relaxation in prices across various commodities, including food, non-food, fuel and power, and manufactured items.

- Inflation in food articles decreased to 3.54% in April, down from 5.48% in March.

- Fuel and power basket inflation also eased to 0.93% in April from 8.96% in March.

- Manufactured products saw inflation at -2.42%, a significant drop from 0.77% in March.

Notably, the slowdown in WPI is in sync with the reduced April retail inflation, which hit an 18-month low of 4.7%.

Deflation Dilemma: Boon or Bane for India?

Interestingly, prior to 2020, the last time WPI in India ventured into negative territory was in February 2015. That event marked the start of a bear market, which hit its lowest point a year later in March 2016.

Whether deflation is good for the Indian economy and the stock market depends on several factors. While the immediate reaction might be that lower prices are beneficial, deflation can have negative effects if it persists over a longer period.

Deflation means that the general level of prices is falling. This could encourage consumers and businesses to delay purchases and investments in the hope of further price reductions. This "waiting game" can lead to decreased demand, resulting in businesses cutting back on production, leading to layoffs and potentially a recession.

Deflation could potentially impact various sectors. Most notably, the banking sector might suffer from squeezed net interest margins due to lower lending rates. Retailers could face falling profits if consumers postpone purchases, anticipating further price decreases. Also, real estate might experience stagnation or decline as reduced inflation erodes the lure of property as an investment. However, export-oriented industries could benefit from the increased competitiveness due to lower production costs.

Deflation can have a negative impact on the stock market as well. If companies sell goods and services at lower prices, their revenues and profits might decline, leading to a drop in stock prices. Also, anticipating falling prices can lead to lower consumer spending, which could further depress corporate profits and, subsequently, stock prices.

However, deflation might not always be bad news. In some circumstances, deflation can be the result of increased productivity and supply. For instance, when technological advances or improvements in efficiency lead to lower production costs, companies can lower their prices. This form of deflation can be beneficial to the economy as it can increase consumers' purchasing power without necessarily leading to a decrease in demand.

Conclusion

In the case of India's recent dip into deflation, it is a result of global commodity prices softening, which has led to decreased costs for producers. If this is a temporary dip, it might actually be beneficial for the Indian stock market and the economy. It can lead to increased profits for companies due to lower input costs, and these higher profits can, in turn, lead to higher stock prices. However, if deflation persists and leads to the negative consequences outlined above, it could end up harming both the economy and the stock market.

Looking for expert guidance and support to navigate the complexities of the stock market during deflationary times? Look no further than Liquide, the perfect app to help you make informed investment decisions. With Liquide, you gain access to expert-recommended trade setups tailored to current market conditions. Our AI-powered bot, LiMo, provides a clear buy/sell recommendations and portfolio health checkups, ensuring you stay on top of your investments. Additionally, Liquide offers transparent real-time tracking and a dedicated hotline for expert support. Don't miss out on this essential tool for investors. Download Liquide now from Google Play Store or Apple App Store for Android and iOS devices to take charge of your investment journey with confidence.