Is Indian IT “Dead” or Just “On Sale”? Decoding the 2026 AI Sell-off

The Nifty IT Index has plunged 21%, leaving investors to wonder: Is AI finally killing the outsourcing model? We break down the "Anthropic Effect," the $650 billion Big Tech capex war and whether this is a market overreaction or a permanent shift.

The Indian IT sector, long considered the "safe haven" of Dalal Street, is currently facing a crisis of confidence. With the Nifty IT Index crashing 21% over the last 12 months, investors are grappling with a terrifying question: Is Artificial Intelligence finally killing the traditional outsourcing model?

From the "Anthropic Effect" to the $650 billion Capex war in Silicon Valley, here is everything an investor in India needs to know about the current tech volatility.

The "Anthropic Effect": Why Indian IT Stocks are Bleeding

The primary trigger for the recent sell-off isn’t just "AI" in the abstract; it’s the arrival of agentic AI. In early 2026, Anthropic (and its "Claude Cowork" suite) unveiled specialized plug-ins that can autonomously handle legal documentation, code maintenance and complex analytics.

For the Indian IT industry, which is built on the labour-driven model of billing by the hour, this is a direct hit.

- The Cannibalization Risk: Traditional revenue streams like ERP implementation and legacy system management—once the "bread and butter"—are now vulnerable to automation.

- Pricing Pressure: If an AI agent can perform the work of five junior developers, the industry's traditional "pyramid" structure (many juniors, few seniors) begins to flatten, squeezing margins.

Big Tech’s $650 Billion Gamble

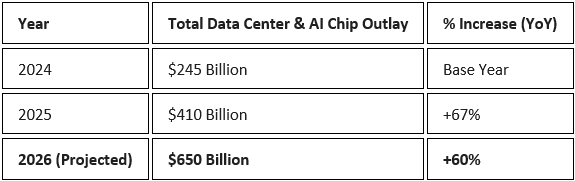

While Indian firms worry about demand, global tech titans (Amazon, Google, Microsoft and Meta) are in a frantic spending war, projected to spend a staggering $650 billion on data centres and AI chips in 2026—a 60% jump from 2025.

The Big Tech Spending Surge (2024–2026)

The Risk for Investors

Despite record revenues—like Alphabet surpassing $400bn for the first time—markets are punishing these stocks. The concern is the "Payback Period."

Amazon’s staggering $200 billion capex roadmap—a massive leap from $131 billion in 2025—coupled with Microsoft’s 66% surge in Q2 FY26 capital spending, signals a sobering reality for the markets: the 'AI Revolution' is a marathon, not a sprint.

This capital-intensive cycle suggests that the timeline for AI to translate into bottom-line profits is lengthening, requiring far more patience and liquidity than investors initially anticipated.

Why Dalal Street is Reacting Violently

Indian IT stocks are highly sensitive to Wall Street sentiment. Since a majority of their revenue is derived from US-based Fortune 500 clients, any "mini timeout" in US tech spending immediately spills over to the Indian markets.

Furthermore, the news that OpenAI’s $100 billion infrastructure deal with Nvidia has stalled has added fuel to the fire. It suggests that even the biggest players are hitting bottlenecks, leading to a "wait and watch" approach from enterprise spenders.

Reality Check: Is IT "Dead" or Just "On Sale"?

While sentiment is fragile, a data-driven look suggests the market may be overreacting. Here is why the "death of IT" narrative is likely premature:

- Fundamental Stability: Current quarterly earnings are largely in line with expectations, showing marginal sequential improvements rather than a collapse.

- No Headcount Crash: We have yet to see the massive reduction in headcount or the "plateauing" of deal flows that would signal a dying industry.

- The Adaptation Curve: This sell-off is fuelled by "AI Anxiety" rather than deteriorating fundamentals. Established Indian firms have a history of navigating shifts—from Y2K to the Cloud—and are already integrating AI into their service stacks.

Conclusion: What Should Investors Do?

The Nifty IT sector remains a laggard and volatility will persist until US tech giants stabilize and the interest rate trajectory clears. However, the bottom line is clear: AI will not erode the global IT revenue pool overnight.

We are currently in a "Show Me the Money" phase. The market has aggressively priced in the threat of disruption but has yet to value the potential of Indian firms as global AI orchestrators.

For the long-term investor, this "valuation compression" offers a strategic window of opportunity—provided you select firms with a concrete AI-integration roadmap.

Should You Buy the Dip in IT Stocks?

Before you pull the trigger, get a second opinion from LiMo — the world’s first AI co-pilot for stock investing. LiMo will advise you on the optimal entry points based on technical indicators and propose possible target levels accordingly.

Explore More with Liquide

Download the Liquide App now & get:

- AI-Powered Verdicts

- Portfolio Health Checks

- Curated Wealth Baskets

Frequently Asked Questions: The 2026 Nifty IT Sell-off

1. Why did the Nifty IT index fall in February 2026?

The sharp decline was triggered by "Anthropic Shock"—the launch of Claude Cowork, an AI agent capable of automating legal and compliance tasks traditionally handled by IT firms. This, combined with strong US jobs data (which reduced hopes of a Fed rate cut), led to a massive liquidation of tech stocks.

2. Is the Indian IT services model dead because of AI?

No. While AI will automate low-level coding and testing, it will create more work than it destroys. Enterprises require "context-aware" integration to make AI tools work with legacy systems—a complex task that remains the core strength of Indian IT.

3. What is the current P/E valuation of the Nifty IT index?

As of mid-February 2026, the Nifty IT P/E ratio has dropped to 23.6, which is below its 1-year average of 26.8 and 2-year average of 29.6. Many analysts view this as a "deep value" zone where the downside is limited compared to historical norms.

4. Which Indian IT stocks are most at risk from AI disruption?

Firms heavily reliant on BPO, maintenance and basic application testing face the highest "revenue deflation" risk. Conversely, Tier-1 players like TCS, Infosys and HCLTech, which are actively partnering with AI-first firms and moving toward "outcome-based" pricing, are better positioned to protect their margins.