India-US Trade Deal: Top Export Stocks to Watch

Following the historic India-US trade deal on Feb 2, 2026, tariffs on Indian goods have been slashed to 18%. From Textiles to Auto Ancillaries, discover the high-exposure stocks poised for a massive valuation re-rating.

The tides of Dalal Street have turned. Following a historic breakthrough in India-US trade negotiations on February 2, 2026, the Indian markets have erupted in a relief rally. With the US slashing reciprocal tariffs from a punitive 25% (and in some cases, a 50% combined levy) down to a competitive 18%, the "hanging sword" over Indian exporters has finally been removed.

For investors in India, this isn't just a news cycle—it’s a fundamental shift in valuation for companies with high US revenue exposure. As the "China+1" strategy regains its momentum, here is your comprehensive guide to the sectors and stocks poised to lead this new bull run.

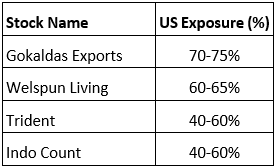

🧵 Textiles: The Biggest Beneficiary

Textile stocks were the biggest victims of the trade war, with some facing 50% combined levies. With the new 18% cap, these companies are looking at an immediate "margin gift."

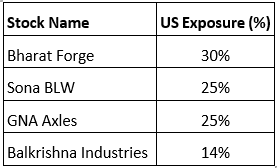

🚗 Auto & Ancillaries: Engineering the Growth

The reduction in trade friction makes "Make in India" components the preferred choice for US automotive giants.

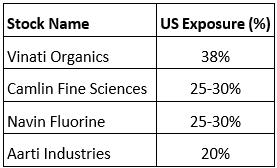

🧪 Chemicals & Pharma: The Strategic Pivot

Specialty chemicals and pharmaceuticals are the backbone of India’s export story. With the US looking to diversify away from China, these stocks are now in the "sweet spot" of favorable policy.

🏗️ Capital Goods & Defence: The New Frontier

The deal isn't just about what India sells; it's about technology transfer. As India aligns closer with the US, joint ventures in high-tech manufacturing are expected to accelerate.

🦐 The Dark Horse: Seafood & Marine Exports

The US is India's largest seafood importer, taking a 34% share of total export value. The 18% tariff cap is a game-changer for marine margins.

💡 Investor Strategy: How to Play the Trade Deal

The market has already reacted with a 2,500+ point jump in Sensex, but the real money will be made in the earnings revisions over the next two quarters.

- Watch the Rupee: The deal has strengthened the INR toward the 90 level. A stronger rupee is great for the economy but can tighten margins for IT exporters.

- Focus on Margins: Look for companies that were previously absorbing tariff costs; they will see the fastest bottom-line recovery.

- The Re-Rating Reality: Many export stocks were trading at a "policy discount." Look for sectors where valuations are still catching up to their new, de-risked growth profiles.

- Sectoral Balance: Don't go all-in on one theme. Diversify your portfolio across sectors for a stable long-term play.

The Big Question: Should You Buy Now?

Before you pull the trigger on a 20% upper-circuit stock, get a second opinion from the world's most advanced research desk.

Ask LiMo — the world’s first AI co-pilot for stock investing. LiMo will advise you on the optimal entry points based on technical indicators and propose possible target levels accordingly.

Explore More with Liquide

Success in this new trade regime requires more than just luck; it requires data. With Liquide, you get:

- AI-Powered Verdicts

- Portfolio Health Checks

- Curated Wealth Baskets

Download the Liquide App now and turn the India-US trade deal into your portfolio's biggest win of 2026.