Weekly Recap: Nifty Extends Losing Streak as Investor Sentiment Turns Cautious

Markets continued their downward slide last week, with Nifty losing nearly 1% amid mixed earnings, FII outflows and global uncertainty. Here’s a quick recap of the biggest stories, top gainers and losers and what to expect in the week ahead.

Markets continued their downward streak, recording the largest weekly drop in the past month as sentiment turned cautious. Here's our take on this week gone by, some stories you might have missed out on and our thoughts on what to do going ahead, in your weekly report.

Slippery Slope

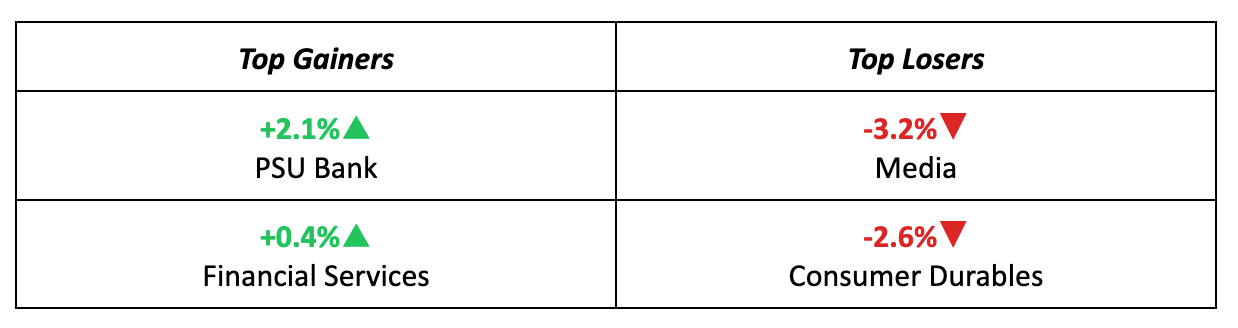

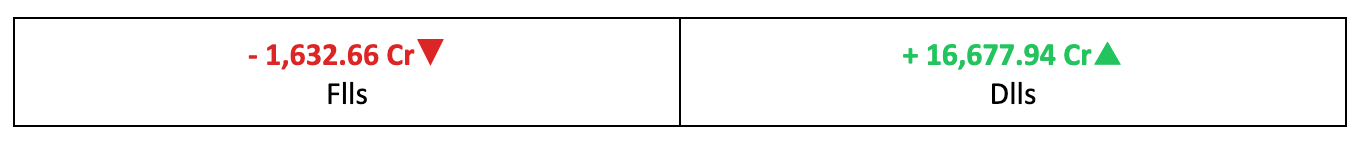

- Markets ended lower for the second straight week, with Nifty slipping nearly -1% amid mixed corporate earnings, persistent FII outflows and uncertainty surrounding tariff talks with the US.

- Within the broader market, the BSE Large-Cap Index declined -0.8% and the BSE Mid-Cap Index shed -0.6%. The BSE Small-Cap Index was the worst hit, tumbling -1.5%.

- The India VIX climbed over 3% during the week, signalling rising investor unease amid global and domestic uncertainties.

The Big Stories

- Global markets slipped as valuation worries hit tech stocks, fuelled by “Big Short” investor Michael Burry’s $1.1 billion bearish bet against AI majors Nvidia and Palantir. Read more: The $1 Billion Bet Against AI

- At home, PSU banks stayed in the spotlight for the second week, driven by stronger fundamentals and buzz around higher FII limits. Nuvama estimates that raising the cap from 20% to 49% could draw up to $4 billion in passive inflows.

The Winners

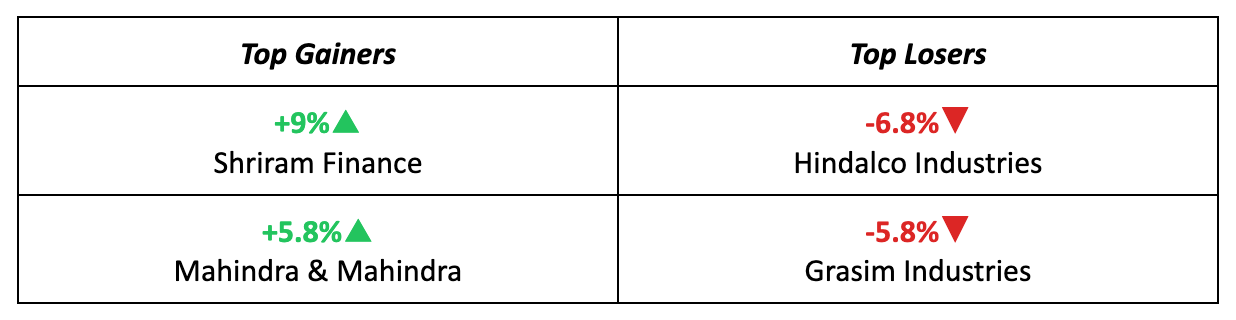

- Shriram Finance topped the charts after Q2 earnings surpassed estimates, prompting several brokerages to turn bullish on the stock.

- M&M also fared well, gaining nearly 6% over the week following a strong Q2 earnings beat and an upbeat growth outlook from brokerages.

The Losers

- Hindalco slid nearly 7% after a fire at its US-based subsidiary Novelis’ plant sparked concerns of a potential $650 million impact on cash flows and capex.

- Grasim fell about 6% after Rakshit Hargave, head of its paints arm Birla Opus, resigned just 18 months after its launch.

Meanwhile

- In the US, consumer sentiment slumped as the country faced its longest government shutdown in history. The University of Michigan’s consumer sentiment index fell to 50.3 in November — the lowest since June 2022.

- Back home, India’s Manufacturing PMI rose to 59.2 in October from 57.7 in September, supported by GST-related tailwinds and easing input costs.

Market Brief

Market Outlook

Our Take

- The week was marked by profit-booking as investors turned cautious amid lingering uncertainty around trade and tariff discussions, coupled with a lack of fresh domestic triggers.

- We expect the consolidation phase to continue, with Nifty likely to trade within a range of 25,100–25,750 in the coming week.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions.

Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.