Hyundai Motor India Shares List at 1% Discount to IPO Price

Hyundai Motor India lists at a slight discount in its highly anticipated IPO. Dive into our analysis of its stock performance, market reactions and discover the broader trends in large IPOs.

Stocks in News | Hyundai Motor India Ltd made a muted debut on the stock exchanges on October 22, 2024. The shares listed at Rs 1,934 on the NSE, a 1.32% discount to its IPO price of Rs 1,960. This event was one of the most eagerly awaited IPOs of the year, but it started on a subdued note, causing some concern among investors about its initial performance.

Retail and Institutional Response to the IPO

The Hyundai Motor India IPO saw subdued interest from retail investors, which played a major role in the stock’s lacklustre debut. However, strong demand from Qualified Institutional Buyers (QIBs) helped balance this out, as the QIB portion was oversubscribed by 6.97 times.

For an in-depth analysis of why we anticipated a muted debut, check out our detailed blog on Hyundai Motor India IPO Analysis.

Recent Trends in Large IPOs in India

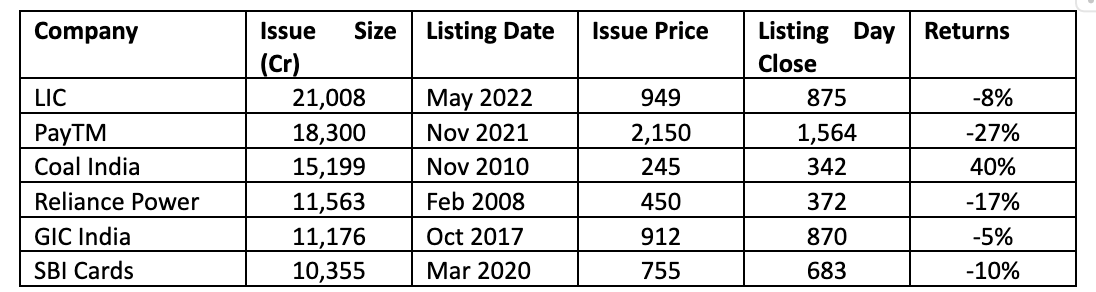

Hyundai’s IPO is part of a trend of large IPOs in India that haven’t always performed well. Of the six IPOs above Rs 10,000 crore, five have listed at a discount, raising concerns for retail investors. Here's a performance snapshot of some of the largest IPOs in India:

Brokerage Perspectives and Future Outlook

Nomura's Analysis

Nomura has pointed out India's low car penetration rate of just 36 cars per 1,000 people, suggesting a significant potential for growth. It projects an 8% CAGR in sales volume from FY25 to FY27, and also expects improvement in EBITDA margins from 13.1% in FY24 to 14% in FY27 due to a superior product mix and operational efficiencies.

Macquarie’s Optimistic Outlook

Macquarie initiated coverage on Hyundai Motor India with an 'Outperform' rating and a target price of Rs 2,235. It argues that the company deserves a higher PE multiple relative to its peers because of its advantageous portfolio mix and premium positioning.

Expert Stock Investment Advice with LiMo

For those seeking expert guidance on stock investments, LiMo, the world's first AI copilot for stock investing, is available exclusively through Liquide. LiMo provides detailed analyses, judgment, and actionable insights based on technical indicators to guide you on when to enter and exit trades.

Start your Investment Journey with Liquide

For an in-depth grasp of the financial markets and potential investment avenues, delve deeper with Liquide. Boasting advanced tools like LiMo and thorough market insights, Liquide equips you with the knowledge to make informed investment decisions. Download the Liquide App now and embark on a journey of informed and successful investing.