HDFC AMC Shares Surge After Strong Q2FY25 Financial Results

HDFC AMC's impressive Q2FY25 results led to a 6% surge in stock price, pushing its market valuation beyond Rs 1 lakh crore. Get insights and investment guidance with Liquide.

Stocks in News | Shares of HDFC Asset Management Company (HDFC AMC), India’s second-largest asset management company, surged by 6% on October 16, following robust Q2 FY25 results, pushing its market capitalization beyond Rs 1 lakh crore for the first time.

This upmove positioned it as the top performer in the Nifty Midcap 100 and was a key driver of the Nifty Financial Services sectoral index's rise on the same day.

Record Growth in Profits and Revenue

During the second quarter of FY25, HDFC AMC reported a substantial 32% year-on-year growth in its profit after tax (PAT), reaching Rs 576.61 crore. This marked a notable increase from Rs 436.52 crore recorded in the same quarter the previous year.

The company's revenue also saw a remarkable rise, climbing 38% to Rs 887.2 crore compared to Rs 643 crore in the corresponding period last year. Similarly, total income escalated by 38%, reaching Rs 1,058.19 crore in the July-September quarter, up from Rs 765.35 crore year-on-year.

For the first half of FY25, HDFC AMC reported a net profit of Rs 1,180.37 crore with a total income of Rs 2,007 crore.

Expanding Assets Under Management

HDFC AMC's assets under management (AUM) grew by 7.5% to Rs 7.58 lakh crore, with significant gains in the debt and liquid market shares. The company maintained a stable equity market share at 12.9%, while its debt market share increased to 13.5% and its liquid market share to 12.1%.

Notably, high-margin equity assets constitute 66% of HDFC's total AUM, outperforming the industry average of 57% in equity assets as of September 2024.

Brokerage Outlook for HDFC AMC

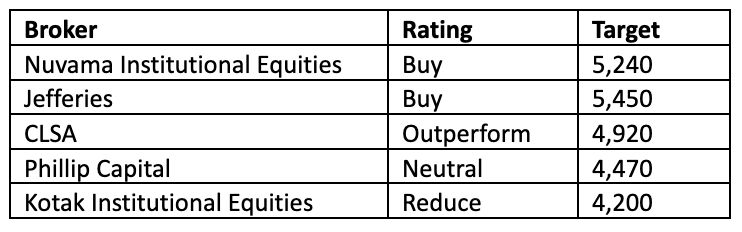

HDFC AMC’s performance garnered attention from various brokerages, leading to mixed ratings and target prices:

Expert Stock Investment Advice with LiMo

For those seeking expert guidance on stock investments, LiMo, the world's first AI copilot for stock investing, is available exclusively through Liquide. LiMo provides detailed analyses, judgment, and actionable insights based on technical indicators to guide you on when to enter and exit trades.

Start your Investment Journey with Liquide

For an in-depth grasp of the financial markets and potential investment avenues, delve deeper with Liquide. Boasting advanced tools like LiMo and thorough market insights, Liquide equips you with the knowledge to make informed investment decisions. Download the Liquide App now and embark on a journey of informed and successful investing.