Weekend Read: The $4.5 Tn Gold Rush—Is it the New Treasury?

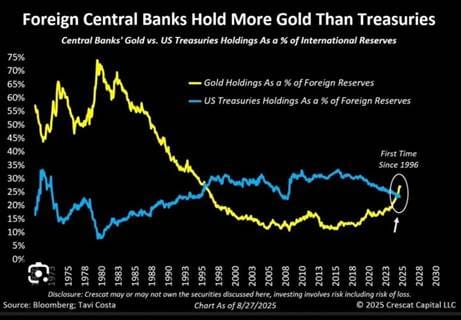

Gold is breaking records in 2025! For the first time in nearly three decades, it has surpassed U.S. Treasuries in central bank reserves, holding a staggering $4.5 trillion. Explore why gold is gaining ground and how this shift might affect your investment strategy.

In a historic shift marking the first time since 1996, gold has officially surpassed U.S. Treasuries in the international reserves held by central banks. Yes, gold is back and it’s shining brighter than ever!

The Golden Stats You Should Know

Central banks now collectively hold about 36,700 tonnes of gold, worth a whopping $4.5 trillion. That’s more than their holdings of U.S. Treasuries, valued at $3.5 trillion. Gold is now the second most significant reserve asset, accounting for 27% of total foreign reserves—completely overshadowing the euro's 16%, but still behind the U.S. dollar's 46%.

Check out these annual gold purchases by global central banks:

- 2022: 1,082 tonnes

- 2023: 1,037 tonnes

- 2024: A record 1,180 tonnes

To put this in perspective, gold purchases in recent years have more than doubled compared to the previous decade when the average was only 400-500 tonnes annually. And while there’s been a slight cooldown in 2025, central banks are still expected to buy about 1,000 tonnes of gold this year.

What’s Driving This Golden Rush?

- Geopolitical Risks & Sanctions: The freezing of Russia's reserves in 2022 was a wake-up call, showing how vulnerable dollar-based assets can be. Gold, on the other hand, is immune from sanctions and political risks.

- Diversification Away from the Dollar: About 76% of central bankers plan to slash their dollar holdings over the next five years. Gold, being a tangible and independent asset, is their go-to for diversifying risk.

- U.S. Fiscal Concerns: High U.S. debt and credit rating worries are shaking faith in Treasuries, pushing central banks towards gold’s historic stability.

- Inflation & Monetary Policy Uncertainty: With inflation running hot and central banks experimenting with unconventional monetary policies, gold shines as the ultimate inflation hedge.

- Strong Performance: This year alone, gold prices jumped over 35%, breaking past $3,500 per ounce—a turbo boost that makes gold even more irresistible.

Why Treasuries Are Losing Ground

U.S. Treasuries, once the bedrock of global reserves, have stumbled under the weight of surging U.S. debt, rising yields and the political risks tied to dollar assets. Central banks have faced losses on bond holdings as interest rates surged, while U.S. fiscal strains and sanction risks have dented trust in Treasuries. With holdings slipping to $3.5 trillion, they’ve ceded ground to gold for the first time in nearly three decades!

What’s Happening in India?

India is actively participating in this global trend, with the Reserve Bank of India (RBI) increasing its gold holdings to around 880 tonnes by March 2025, constituting roughly 12% of India’s total reserves. This move strengthens the rupee’s stability amid currency fluctuations and global uncertainty.

Here’s how India compares within global gold ownership:

|

Country |

Gold

Reserve Tonnes |

Holdings

% |

|

USA |

8,133.46 |

77.85 |

|

Germany |

3,350.25 |

77.50 |

|

Italy |

2,451.84 |

74.23 |

|

France |

2,437.00 |

74.96 |

|

China |

2,298.53 |

6.70 |

|

India |

879.98 |

13.08 |

|

Japan |

845.97 |

6.81 |

|

Turkey |

634.76 |

50.11 |

|

Netherlands |

612.45 |

68.07 |

|

Poland |

515.47 |

22.00 |

What Does This Mean for Investors?

The rise of gold in central bank reserves sends clear signals:

- Gold Prices May Rise: Central bank demand can fuel higher prices, which could affect gold jewellery and investment prices in India.

- Currency Stability: Gold reserves help buffer India’s currency against global shocks.

- Shifting Global Finance: This shift signals changing trust in the dollar-led system and a move toward a more diversified and possibly multipolar global financial landscape.

For individual investors, gold's strategic importance means it’s worth considering as part of a well-balanced portfolio. Especially relevant is gold’s role as a hedge against inflation and geopolitical risks.

In fact, India’s gold ETFs saw strong demand in 2025:

- Holdings rose by 42% year-over-year to 66.68 tonnes by June 2025

- Assets under management jumped 88% to Rs 64,777 crore

- Investor accounts expanded by 41% to 76.54 lakh

These figures highlight how Indian investors are embracing gold through accessible digital channels.

Will the Gold Rush Continue?

The broader trend suggests that, while short-term fluctuations may occur, gold remains an attractive asset for diversification and inflation protection through 2025 and beyond. Central banks are increasing their gold reserves and this shows how the global financial landscape is being rethought, with gold playing a bigger role. While the U.S. dollar continues to dominate, the increasing allocation to gold signals a cautious diversification strategy in uncertain times.

For investors, this is a reminder of why gold is so valuable—not just as a defence against inflation or market volatility, but as a core part of a balanced portfolio. Look at 2022: while equities and bonds took a hit, gold still managed to pull off a 3% gain, proving its worth as a safety net.

As central banks continue to favor gold, it becomes clear that this precious metal’s role in the global economy is only set to grow stronger.

Stay updated with our latest blog posts and expert insights with Liquide. Download Liquide App now to access real-time market analysis and recommendations tailored to enhance your investment strategy.