From Record-Low NPAs to 7.2% Growth: 5 Must-See Highlights from India’s 2026 Report Card

As the Union Budget approaches, the Economic Survey 2026 reveals a resilient Indian economy. With a projected GDP growth of 7.2%, record-low NPAs and a strategic shift in global trade, discover the key takeaways from the CEA’s latest "economic report card."

The stage is set for the Union Budget. On Thursday, January 29, 2026, Finance Minister Nirmala Sitharaman tabled the Economic Survey 2025–26 in Parliament. Prepared by Chief Economic Adviser (CEA) V. Anantha Nageswaran, the report serves as a definitive health check of the nation’s economy, signalling the fiscal roadmap before the full Budget is unveiled on February 1.

The verdict? While the global landscape remains "fragile," India is standing its ground with a projected GDP growth of 6.8% to 7.2% for FY27.

What is the Economic Survey?

The Economic Survey is an annual flagship document that reviews the performance of the Indian economy over the past year. It outlines government policy impacts and provides an outlook for the upcoming financial year.

Think of it as the country’s annual economic report card. The report is drafted by the Economic Division of the Department of Economic Affairs under the guidance of the CEA.

A Resilient Domestic Economy

Despite weak global signals and trade uncertainties, India’s macro fundamentals remain rock-solid. The Survey suggests that the country’s medium-term growth potential is now gravitating toward the 7% mark, thanks to consistent policy reforms.

"For India, global conditions translate into external uncertainties rather than immediate macroeconomic stress," the Survey notes, emphasizing that domestic demand remains the primary engine of growth.

Inflation Outlook: Rising but Managed

The Survey adopts a stance of "caution but not pessimism" regarding inflation. Headline inflation is expected to rise slightly in FY27 compared to FY26, likely touching the 4% target range. The IMF had projected inflation rates of 2.8% in FY26 and 4% in FY27.

- The Silver Lining: A healthy monsoon and stable fertilizer supplies are expected to keep food inflation in check.

- The Risk: A weaker Rupee could lead to "imported inflation," though cooling global commodity prices should act as a buffer.

Fiscal Discipline: The Path to 4.4%

The government remains committed to its fiscal consolidation glide path. After achieving a deficit of 4.8% in FY25, the target for FY26 is set at 4.4%.

As of November 2025, the union government’s fiscal deficit stood at 62.3% of the Budget Estimates, indicating disciplined spending and robust tax collection.

Banking Sector: Historic Strength

Scheduled commercial banks have shown marked improvement, with asset quality reaching decadal highs.

- Record Low NPAs: Gross NPA stood at 2.2% and net NPA at 0.5% in September 2025.

- Credit Surge: Outstanding credit grew 14.5% by December 2025, a significant acceleration from 11.2% the previous year, signalling strong trust in the credit cycle.

Manufacturing: The Missing Link

While India remains a global powerhouse in services, the Survey highlights a critical reality: Services cannot fully replace a manufacturing-based export ecosystem.

To transition into a fully developed economy, the Survey calls for "system-wide state upgrading" to support a robust manufacturing sector, ensuring India isn't just a back-office for the world, but a factory floor as well.

FDI Inflows: Investors Keep the Faith

Foreign Direct Investment (FDI) saw a massive boost in the first eight months of FY26.

- Gross Inflows: Hit $64.7 billion, a significant jump from $55.8 billion the previous year.

- Net FDI: Increased nearly sevenfold to $5.6 billion during the April-November 2025 period.

Capital is increasingly flowing into the "New Economy"—specifically digital services, data centres and IT infrastructure— proving that the world still views India as a premium investment destination.

The Great Export Pivot: Moving Beyond the US

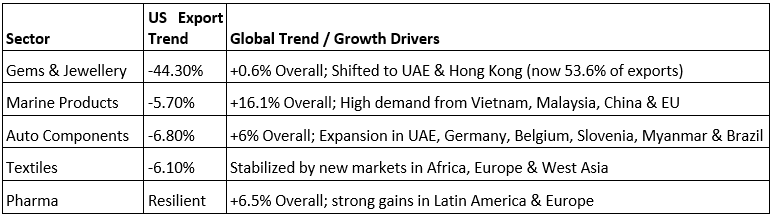

One of the most striking revelations in the 2026 Survey is India’s strategic trade shift. Faced with tariff uncertainties, Indian exporters are aggressively diversifying into the Middle East, Europe, Africa and Southeast Asia.

Data from April–November FY26 confirms this shift, showing a clear divergence between declining exports to the US and rising shipments to the rest of the world.

Sector-Wise Export Shifts:

The Bottom Line

The 2026 Economic Survey paints a picture of an economy in transition—moving away from a single-market dependency and doubling down on domestic resilience. As the world faces volatility, India’s 7.2% growth projection positions it as the undisputed bright spot in the global economy.

Stay Ahead of the Curve this Budget Season!

The Economic Survey is just the beginning. With the Union Budget 2026 right around the corner, big policy shifts are coming. Will there be tax relief? New manufacturing incentives? Major infra spending?

Subscribe now for real-time alerts, expert breakdowns, and actionable insights delivered straight to your inbox.

📲 Download the Liquide App for Real-time Budget Updates!