Decoding the US Debt Ceiling: What Happens If America Defaults?

Learn what the debt ceiling is, why the US might default, and how it could affect the economy and your finances.

The US debt ceiling crisis has been making headlines worldwide, for obvious reasons. The tense standoff between President Joe Biden and Republican members of Congress over the debt limit has evolved into a serious threat to the US economy and global stock markets. Simply put, the US government could start to run out of money within weeks unless it allows itself to borrow more. In this blog, we will delve into the intricacies of the US debt ceiling crisis and its potential impact on economies worldwide, with a particular focus on India.

What is the Debt Ceiling and why does it matter?

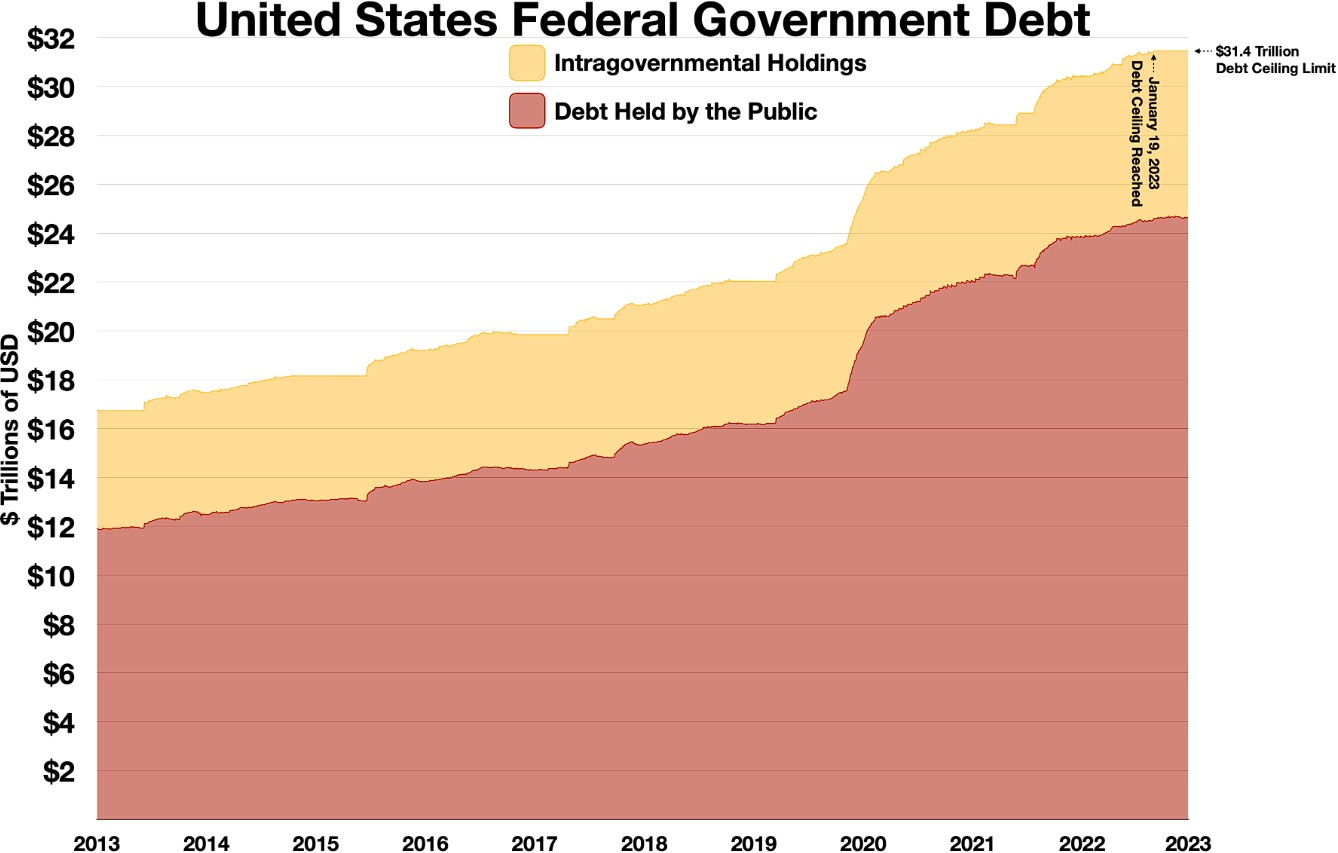

The debt ceiling is the maximum amount of money the US government can borrow to pay for essential services, such as military salaries, Medicare, and social security. Each year, the government spends more than it earns through taxes and other revenue sources, creating a deficit. This deficit is added to the nation's total debt, and the US Treasury issues securities and bonds to cover it.

However, the Treasury can only do this up to a certain limit, known as the debt ceiling. If the debt limit is not raised, the government may default on its bills, leading to severe economic consequences.

Why isn't the Debt Ceiling being raised?

The debt ceiling has been a subject of political stalemate. Republicans have proposed raising the debt ceiling by $1.5 trillion, but only if accompanied by $4.8 trillion in spending cuts over ten years. Democrats disagree, arguing that spending cuts should be negotiated separately from the debt ceiling. With both sides unwilling to compromise, the stalemate persists, putting the US economy at risk.

Has it happened before?

Since 1960, the US Congress has taken action on the debt ceiling 78 times, according to the Treasury Department. Both Democratic and Republican administrations have approved these increases, with Democrats doing so 29 times and Republicans 49 times. This consensus reflects the recognition that raising the debt ceiling is crucial in preventing irreversible damage to the US economy, the well-being of Americans, and global financial stability.

How would a Default affect the US and the World Economy?

The global implications of a US default could be catastrophic. The US dollar serves as the world's primary reserve currency, and US Treasury securities are widely held as safe assets. A default could shake confidence in these assets, leading to global economic instability. If investors move away from US assets, it could cause severe market volatility and increase borrowing costs worldwide. Moody's Analytics projects that a default would result in a 4% drop in GDP and a loss of over 7 million jobs.

According to economists, a US default could increase federal borrowing costs by $750 billion over the next decade, leading to job losses and negatively impacting the world economy. The nation's credit rating would likely be downgraded, making borrowing more expensive for the US government and potentially for individuals as well. In addition, a default could weaken the US's position on the global stage, opening opportunities for rivals like Russia and China to take advantage.

How would it impact the Indian Economy?

As an emerging economy, India has a significant stake in the stability of the US economy. Several ways a US default could affect India include:

- Trade and Investments: The US has emerged as India's biggest trading partner in 2022-23 on account of increasing economic ties between the two countries. According to the provisional data of the commerce ministry, the bilateral trade between India and the US has increased by 7.65% to $128.55 billion in 2022-23 as against $119.5 billion in 2021-22. A US default could lead to a slowdown in the American economy, potentially reducing demand for Indian goods and affecting India's exports.

- Equity Markets: Indian stock markets could face considerable volatility. FII flows into India could reverse, causing sharp drops in equity markets.

- IT Industry: The Indian IT sector, which earns a significant portion of its revenue from the US, may also feel the pinch. A slowdown in the US economy could reduce IT spending, impacting the revenues of Indian IT companies.

Conclusion

Although the chances of a default are very low, it is essential to watch the developments in Washington as the US debt ceiling crisis is more than an American problem. Any decision to raise, maintain, or ignore the debt ceiling directly influences the US economy's stability, thereby affecting global trade, finance and stock markets. While a decision is anticipated in the near future, any delays would only extend the uncertainty which in turn could lead to sudden downgrades, a fall in indices and perhaps a temporary rise in safe-haven instruments such as gold. On the other hand, any positive news by this weekend, like a decision to enhance the ceiling, will foster renewed optimism among investors next week.

In times of uncertainty and potential economic disruptions, having a reliable investment app like Liquide can provide valuable support and guidance. Liquide offers unique features such as real-time market data, expert-recommended trade setups, and personalized investment advice, allowing investors to stay informed and make well-informed decisions even during challenging times. Whether you're monitoring the impact of the US debt ceiling crisis on global markets or seeking opportunities amidst volatility, Liquide can be your trusted companion. Download Liquide from the Apple App Store or Google Play Store today and empower yourself with the tools and knowledge to navigate the ever-changing financial landscape with confidence.