Compounding Your Way to Financial Freedom: The Power Unveiled

Unlock the Power of Compounding: Grow Your Wealth Gradually with Expert Strategies. Maximize Returns through Long-Term Investing and Smart Investment Choices. Start Your Journey to Financial Success Today.

Introduction

Have you ever wondered how to gradually increase your riches without putting in a lot of work? Are you seeking solutions to fulfil your life goals and secure your financial future? Compounding is a potent tool that can be used to help you achieve your goals.

Understanding Compounding: The Snowball Effect

Compounding is often called the snowball effect because it allows your money to grow exponentially over time. It is fundamentally the act of receiving returns on your initial investment and the cumulative earnings from earlier periods. This indicates that any interest or returns you receive are reinvested, resulting in further returns in succeeding periods. This snowball effect can cause your wealth to increase significantly over time.

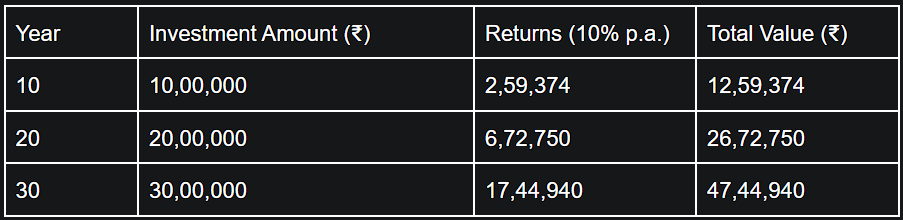

Let's use a real-world example to demonstrate the value of compounding in the context of India. Consider making a yearly investment of Rs. 1 lakh in a plan that pays a 10% annual compounding interest rate. Let's look at the increase of your investment after 10, 20, and 30 years to better understand the effects of compounding across various time periods:

The table shows that compounding has a higher influence the longer your money is invested. Your initial investment of 30 lakhs has increased to Rs 47,44,940 over the course of 30 years, with the compounding effect playing a substantial role in this rise. This illustration emphasizes the need to start early and allow enough time for your investments to compound.

Factors Influencing the Power of Compounding

To make the most of compounding in the Indian scenario, it is essential to consider several key factors:

1. Rate of Compounding: Compound interest refers to the interest rate at which an investment increases over time. That will determine the return you get from your investment.

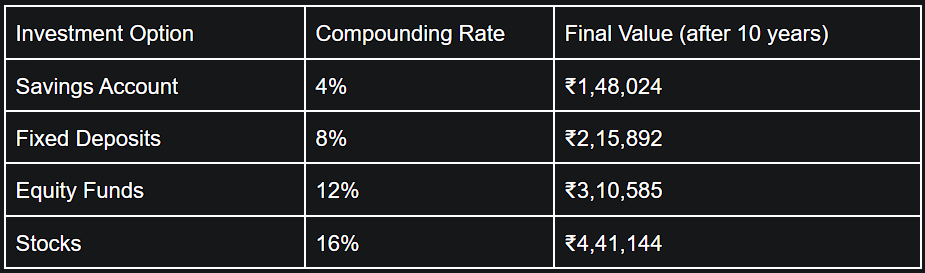

Let's look at an example to understand the impact of compound interest. Let's say you want to invest an initial capital of Rs 100,000 in various investment options at various interest rates for 10 years, as shown in the table below.

In this example, you can see that the compounding rate significantly affects the final value of your investment. Higher compounding rates lead to greater returns and result in a larger accumulated amount over time.

It is important to consider the compounding rate when making investment decisions, as it can greatly impact your wealth accumulation in the long run.

2. Investment Duration: The duration for which you can keep your money invested plays a crucial role in maximizing the benefits of compounding.

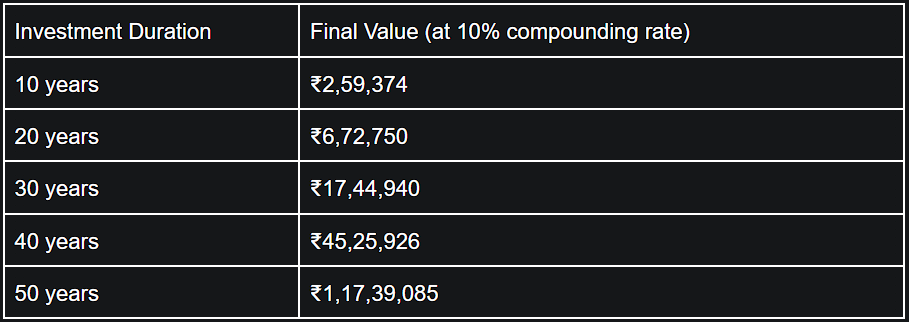

Let's consider an example to illustrate the importance of investment duration. Suppose you invest an initial capital of ₹1 lakh at a compounding rate of 10% for different time durations, as shown in the table below:

In this example, you can see that the longer you keep investing, the more your wealth grows due to the compounding effect. Just as a tree grows taller and bears more fruit over time, the longer the investment, the greater the return on investment.

Investing uninterrupted for long periods of time gives you even more time to work the magic of compound interest and create massive wealth. It emphasizes the importance of starting early and investing for the long term to maximize the benefits of compound interest.

3. Tax Considerations: Understanding the tax implications of your investments is essential. Certain investment options, such as mutual funds and stocks held for the long term, offer tax benefits and can enhance your compounding returns. Consulting with a tax advisor can help you optimize your investments from a tax perspective.

Rule of 72: Doubling Your Money

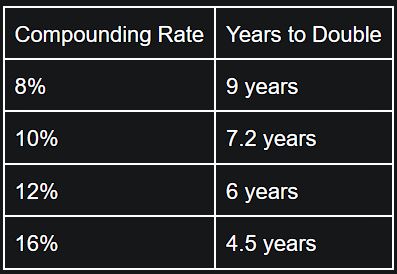

Another concept that helps you understand the power of compound interest is the rule of 72. Based on the compounding rate, you can easily estimate how long it will take for your funds to double. Dividing 72 by the compound interest rate gives you an estimate of the number of years it will take to double your investment.

Let's illustrate the rule of 72 with an example.

As shown in the table, if you invest at an interest rate of 8%, your money will double in about 9 years. Similarly, at an interest rate of 16%, the investment will double in about 4.5 years. The Rule of 72 helps you understand how long it takes for your money to grow and how different compounding rates affect the speed at which you accumulate wealth.

Applying the Rule of 72 helps you make informed investment decisions and set realistic expectations for your financial goals.

Leveraging Compounding for Maximum Returns

To maximize the benefits of compounding, consider the following strategies:

1. Long-Term Investing: Compounding works best when you have a long-term investment horizon. By staying invested for extended periods, you give your investments ample time to compound and generate significant returns. Avoid making impulsive decisions based on short-term market fluctuations.

2. Diversification: Diversifying your investment portfolio can mitigate risks and enhance compounding returns. Invest in a mix of asset classes, such as stocks, bonds, and mutual funds, to spread your risk and capture opportunities for growth in different sectors.

3. Systematic Investment Plans (SIPs): SIPs are a popular investment strategy in India, especially for mutual funds. By investing a fixed amount at regular intervals, you can benefit from the power of compounding while averaging out market volatility. SIPs are particularly suitable for long-term investors looking to accumulate wealth systematically.

4. Reinvesting Dividends: If you own dividend-paying stocks or mutual funds, consider reinvesting the dividends instead of taking them as cash payouts. Reinvesting dividends allows you to harness the power of compounding and generate higher returns over time.

5. Regular Monitoring and Review: Keep a close eye on your investments and regularly review their performance. Market dynamics and investment opportunities change over time, and staying informed will help you make informed decisions to optimize your compounding returns.

Conclusion

The power of compounding can significantly enhance your savings and investment returns. By starting early, staying invested for the long term, diversifying your portfolio, and making informed decisions, you can harness the full potential of compounding. Remember to consider market indices, tax implications, and the compounding mechanisms of different investment options. With a disciplined approach and a thorough understanding of compounding, you can grow your wealth steadily and achieve your financial goals.

Discover more powerful tools to enhance your investment journey with the Liquide app. Explore features like LiMo, an AI-powered investment advisor providing expert recommendations and personalized trade setups. Get a portfolio health checkup, access market screeners, and receive expert hotline support. Download the Liquide app from the Google Play Store or Apple App Store to optimize your wealth-building strategies and make informed investment decisions aligned with the principles of compounding. Start your journey toward financial success today.

Disclaimer: The information provided in this blog is for educational purposes only and should not be construed as financial advice. Please consult with a qualified financial advisor before making any investment decisions.