Budget 2025: Tax Cuts, Consumption Boost & More!

Union Budget 2025 is here! From zero tax on income up to ₹12 lakh to MSME loan expansion and digital tax reforms, here’s everything you need to know about it and its economic impact.

Finance Minister Nirmala Sitharaman just presented her eighth consecutive Union Budget on February 1, 2025, and there’s plenty to unpack! The government is all set to roll out a brand-new Income Tax Bill next week, pushing forward its "trust first, scrutinize later" approach.

This year's budget focuses on economic growth, tax reforms, digitalization, and social welfare. Here’s a quick breakdown of the big announcements you need to know.

Prioritizing the Poor, Youth, and Women

This year’s Budget is all about empowerment—helping the underprivileged, youth, and women take center stage. The government also plans to tackle underemployment in agriculture, benefiting a whopping 1.7 crore farmers across the country.

Agriculture & Rural Development

- National Mission on High-Yielding Seeds: A fresh initiative to boost agricultural productivity.

- Aatmanirbharta in Pulses: A 6-year mission with a special focus on Tur, Urad and Masoor

- Cotton Productivity Boost: A five-year program to enhance cotton yields.

- Kisan Credit Cards Expansion: 7.7 crore farmers to get higher loan limits—up to ₹5 lakh.

Infrastructure & Logistics

- India Post's Big Upgrade: The postal service is evolving into a major public logistics network, covering 1.5 lakh rural post offices.

- New Airports Coming: Bihar is getting new greenfield airports.

- UDAN 2.0: 120 new destinations to be added under the revamped regional connectivity scheme.

Education & Healthcare

- Atal Tinkering Labs: 50,000 new labs to be set up in government schools over the next five years.

- More Medical Seats: 10,000 additional seats in medical institutes, with a goal of hitting 75,000 in five years.

MSME & Business Growth

- Bigger Loans for MSMEs: Small businesses can now avail loans up to ₹20 crore.

- Tailored Credit Cards: Micro enterprises registered on the Udyam portal can avail customized credit cards with a ₹5 lakh limit.

- SWAMIH Fund: Another 40,000 housing units to be completed under this fund in 2025.

- New Fund of Funds: A fresh ₹10,000 crore infusion will expand the fund’s scope to further support MSMEs.

Tourism & Innovation

- Top 50 Tourism Spots: Plans in place to make India's top destinations more attractive.

- National Geospatial Mission: Strengthening the country’s spatial data infrastructure.

- Second Gene Bank: A move towards future food security.

Tax Reforms & Digitalization

New Income Tax Bill: A new Income Tax Bill is expected next week with taxpayer-friendly reforms.

Personal Income Tax Reforms

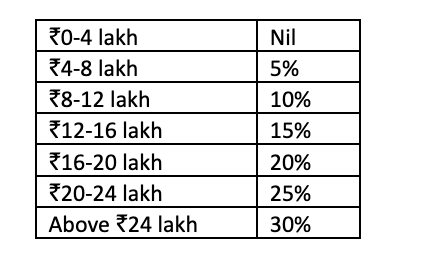

Revised tax slabs under the new regime:

Key Benefits:

- Zero tax for income up to ₹12 lakh.

- Capital Gains Limit raised to ₹12.7 lakh.

- Extended Return Filing Window – 48 months instead of 24.

- Mandatory Crypto Tax Reporting.

- Simplified Property Valuation for self-occupied homes.

- Tax-Free Withdrawals from the National Savings Scheme.

Trade & Industry Reliefs

- Social Welfare Surcharge waived on 82 tariff lines to ease trade.

- Customs Duty Exemption on 36 essential life-saving medicines.

- Handicrafts Industry Boost, adding 9 new items to the duty-free input list.

Business Ease & Compliance Reforms

Initiatives to simplify regulations and boost entrepreneurship include:

- Jan Vishwas Bill 2.0, decriminalizing 100 legal provisions.

- Simplified Tax Compliance for charitable trusts.

- Arms-Length Pricing Reform for fair international transactions.

- Tax Digitalization Expansion for easier compliance.

- Startup Incorporation Benefits extended for five more years.

Technology & Energy Development

- AI Centre of Excellence: ₹500 crore investment in AI-driven education.

- Nuclear Energy Mission: ₹20,000 crore allocated for Small Modular Reactors (SMR) research.

- Maritime Development Fund: ₹25,000 crore corpus to enhance maritime infrastructure.

Economic Outlook & Fiscal Management

- Fiscal Deficit projected at 4.8% of GDP.

- Capital Expenditure allocation of ₹10.18 lakh crore.

- Gross Market Borrowings estimated at ₹14.82 lakh crore.

Conclusion: Budget 2025: A Big Win for the Middle Class & Consumption!

Budget 2025 packs a punch where it matters most — putting more money in people’s pockets and boosting spending. While there weren’t any big-ticket announcements for railways or defence, sectors like FMCG, Real Estate, and Auto stand to gain.

The biggest headline? Zero tax on income up to ₹12 lakh (excluding capital gains), easing the burden on the middle class and driving demand. Plus, higher exemptions, tax relief for seniors, and a ₹10,000 crore push for startups make this a budget focused on growth.

While the market remains cautious due to the lack of clarity on capital gains taxation, this may be addressed in the upcoming tax bill. All in all, it’s a budget that prioritizes consumption-driven growth!

Stay Ahead with Liquide

Want a deeper dive into Budget 2025? Check out our BudgetCommentary

where we break down every key announcement, sector impact, and what it means for your investments. Not on the Liquide App yet? Download now for real-time trading insights, expert analysis, and actionable strategies to make smarter moves in the market!