Blue Jet Healthcare IPO Opens Today: Should You Subscribe?

Get a detailed overview of Blue Jet Healthcare’s IPO, including GMP, verdict, issue details, and the company's strengths and risks.

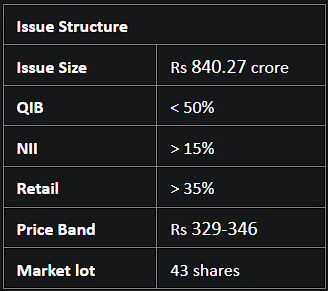

The initial public offer (IPO) of Blue Jet Healthcare, which opens for subscription on October 25, will close on Friday, October 27. The price band for the IPO has been set at Rs 329-346 per share. At the upper end of the price band, the pharmaceutical firm seeks to raise about Rs 840 crore. Investors can bid for a minimum of 43 equity shares and in multiples thereafter.

The public offering, with a face value of Rs 2 per share, is purely an offer for sale (OFS) for up to 2.42 crore shares. In this OFS, promoters Akshay Arora and Shiven Arora will offload shares.

According to market insiders, the grey market premium (GMP) for this IPO is Rs 63 (a premium of ~18% over the IPO price).

Anchor Round

Before the IPO's launch, Blue Jet Healthcare raised Rs 252.08 crore from anchor investors. ICICI Prudential Fund, HDFC Mutual Fund, Nippon Life India, Aditya Birla Sun Life Insurance, Government Pension Fund Global, HSBC Global Investment Fund, Edelweiss Trusteeship and BNP Paribas were among the notable investors who participated in the anchor round.

About Blue Jet Healthcare

Blue Jet Healthcare Ltd specializes in pharmaceutical and healthcare ingredients, producing niche products for innovator pharmaceutical firms and multinational generic pharmaceutical entities. Their offerings span across three categories: contrast media intermediates, high-intensity sweeteners, and pharma intermediates coupled with active pharmaceutical ingredients (APIs).

The firm holds a significant position as a prominent manufacturer of contrast media intermediates in India, a sector with substantial entry barriers. It predominantly provides vital intermediates to three global giants, in contrast, media manufacturing: GE Healthcare AS, Guerbet Group, and Bracco Imaging S.p.A.

From FY21 to FY23, the company exhibited a decent growth trajectory with a compounded annual growth rate (CAGR) of 20% in Revenue, 3% in EBITDA, and 9% in Net Profit.

Key Concerns

- Dipping Profit Ratios: The company has observed a significant drop in its profitability ratios. The EBITDA margin decreased from 41.3% in FY21 to 36.5% in FY22 and further declined to 30.4% in FY23. Similarly, the net profit margin shrank from 27.2% in FY21 to 22.2% in FY23.

- Declining Trend in Return Metrics: The Return on Capital Employed saw a decline from 49.7% in FY21 to 31.9% in FY23. Concurrently, the Return on Equity (ROE) dipped from 50.2% to 26.6% within the same timeframe.

- Dependency on Key Clients: A considerable chunk of the company's revenue comes from a limited number of key clients. The potential loss of any of these customers could be detrimental to its business. Notably, in Q1FY24 and FY23, sales from its biggest client constituted ~60% and 63% of its total sales.

- Currency Exchange Risks: With a large part of its revenue in foreign denominations, the company faces significant exchange rate risks. In the last three fiscal years, overseas sales accounted for more than 80% of the total revenue.

Our Verdict: Subscribe for Listing Gains

While the firm showcases a consistent increase in revenue and earnings, it's concerning to see a noticeable drop in its profit margins and performance indicators. Furthermore, the heavy dependency on its principal customer, making up roughly 63% of sales, is a red flag. These issues, along with the risks outlined above, present reservations.

In terms of valuation, the issue seems fully priced at a P/E multiple of 34x on annualised FY24 earnings. The grey market premium (GMP) for the issue, however, indicates a premium listing.

Considering the overall scenario, investors can consider participating in this IPO just for listing gains. Investors must note that the issue is solely an offer for sale, meaning no funds will be directed to the company's future growth or development.

Unlock a world of financial opportunities with Liquide, the ultimate app for the modern investor. Featuring advanced tools like LiMo, India's pioneering AI co-pilot for stock investing, Liquide empowers you with insights that can guide your financial journey. Stay updated with thorough market analysis, expert recommendations, and real-time information. Download the Liquide app today from the Google Play Store or Apple Appstore and embark on a journey of informed and successful investing. Don't miss out on the powerful features that can shape your financial future.