Axis Bank Q2FY25 Results: Profit Jumps 18%, NPAs Improve

Axis Bank’s impressive Q2FY25 results, including an 18% jump in net profit, lead to a 5% surge in stock price. Get detailed insights and investment guidance with Liquide.

Stocks in News | On October 18, shares of Axis Bank surged nearly 5%, following an impressive second-quarter performance, where the bank reported an 18% year-on-year increase in net profit, reaching Rs 6,917.57 crore. The significant rise in profit was mainly fuelled by a strong core lending income, underpinned by robust credit demand.

Net Interest Income and Margins See Growth

Axis Bank saw its Net Interest Income (NII) grow by 9%, reaching Rs 12,234 crore, while the Net Interest Margin (NIM) stood solid at 3.99%. The bank also reported a rise in fee income, which climbed 11% year-over-year and 6% quarter-over-quarter.

Overall, the total income escalated to Rs 37,142 crore for the reported period, up from Rs 31,660 crore the previous year.

Deposits and Advances Surge

The lender reported a substantial 14% increase in deposits, reaching Rs 10.87 lakh crore, up from Rs 9.56 lakh crore in the year-ago quarter. Notably, term deposits soared by 21% year-on-year.

Current Account Savings Account (CASA) deposits grew by a modest 4% year-on-year to Rs 4.41 lakh crore.

On the advances front, the bank's net advances increased by 11% year-on-year and 2% quarter-over-quarter.

Stable Financial Health Indicators

Axis Bank's overall Capital Adequacy Ratio (CAR) was reported at 16.61%, with a Common Equity Tier 1 (CET-1) ratio of 14.12%.

The bank also saw an improvement in asset quality, with the Gross Non-Performing Assets (GNPA) ratio declining by 29 basis points year-on-year to 1.44%, and the Net Non-Performing Assets (NNPA) ratio slightly decreasing to 0.34%.

Dominance in UPI Payments

In a significant achievement, Axis Bank secured the number one position in the UPI Payer Payment Service Provider (PSP) space, capturing approximately 31% of the market.

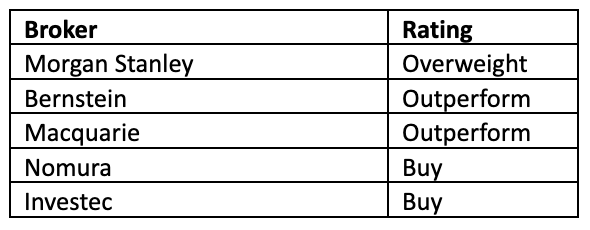

Brokerage Outlook for Axis Bank

Axis Bank's recent performance has prompted a number of brokerages to give positive ratings. Here's a summary of the varying ratings from different brokerages:

Expert Stock Investment Advice with LiMo

For those seeking expert guidance on stock investments, LiMo, the world's first AI copilot for stock investing, is available exclusively through Liquide. LiMo provides detailed analyses, judgment, and actionable insights based on technical indicators to guide you on when to enter and exit trades.

Start your Investment Journey with Liquide

For an in-depth grasp of the financial markets and potential investment avenues, delve deeper with Liquide. Boasting advanced tools like LiMo and thorough market insights, Liquide equips you with the knowledge to make informed investment decisions. Download the Liquide App now and embark on a journey of informed and successful investing.