Why 2025 Punished Lazy Portfolios | Here’s How to Prepare for 2026

From Nifty’s volatile journey to gold and silver’s historic rally, 2025 reshaped Indian investing. Here’s a complete market recap and how investors can make 2026 more profitable.

As 2025 draws to a close, it’s time to reflect on the year that was, assess the key trends and strategize for the year ahead. From gold and silver shining bright to a bumpy ride for equities, this year has had its ups and downs.

On the global stage, US stocks rode the AI hype wave high, helping world markets head towards their strongest annual gains in six years. Back home, Nifty 50 clocked ~10% this year after blockbuster prior runs, lagging global peers but still solid over five years.

On the flip side, the rupee had a tough 2025 despite strong growth and low inflation, slipping past key psychological levels as export-hit tariffs and tighter H1B rules hurt sentiment. On top of that, FII outflows and weak foreign interest in rupee assets kept the currency under sustained pressure.

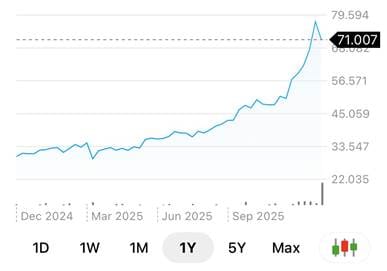

Nifty 50: The Year in Review

Coming back to Indian equities, 2025 was a year of mixed performance. Let's break down the Nifty 50's journey point by point—it jumped from 23,743 on January 1 to 26K levels by December 31, netting a ~10% gain.

Plenty of plot twists kept us on edge.

Q1: Budget Boost & First Rate Cut in Years

- The year kicked off with the Union Budget raising the zero-tax limit to Rs 12 lakh, giving a boost to investor sentiment.

- The RBI also surprised us by cutting rates for the first time since 2020, helping push the Nifty up to 23,166 by April 1.

Q2: Aggressive Cuts Amid Cooling Inflation

- The global mood turned edgy as the US slapped tariffs on India and several other nations.

- But the RBI didn’t back down—it delivered another rate cut in April, followed by a bold 0.50% cut in June, the most aggressive since 2019.

- Inflation dropped to 1.55% and the Nifty surged to 25,542 by July 1.

Q3: Tariffs Bite, But Growth Shines

- US slapped 25% tariffs on India in August, doubling to 50% soon after.

- Yet, GDP roared 7.8% and S&P upgraded India's credit rating for the first time in 18 years.

- The Nifty raced to 24,836 by October 1.

Q4: Tax Reforms & Record Highs

- India nailed a massive GST revamp—slashing to two slabs (5% and 18%) plus 40% on luxuries/sins.

- Inflation fell to a historic low of 0.25%, although gold imports swelled the trade deficit.

- Nifty hit a new all-time high of 26,325 and Sensex soared to 86,159.

- Rupee dipped below Rs 90/USD and the RBI delivered another 0.25% rate cut.

- Gold and silver? Sky-high too.

The Elephant in the Room

Let’s address the surprise US tariffs first. Trump's hostile policies stirred up global conflicts (Israel-Gaza, Ukraine-Russia), which sent gold through the roof. Investors went all in on gold for safety and Gold ETFs were on fire—everyone from retail investors to mutual funds jumped on the bandwagon.

India walked a careful tightrope this year. We cozied up to China, kept scooping up Russian oil and juggled ties with the US, Russia and China like pros.

Spotlight on Silver

Meanwhile, silver had its own meteoric rise, driven by strong industrial demand. The precious metal crossed the $77 mark for the first time on December 26, boasting a solid ~167% year-to-date surge, driven by supply gaps and a flood of investment.

Loose Ends as the Year Wraps Up

As the year closes, we’ve still got a few unfinished tasks. The Indian government is still working on a trade deal with the US to sort out tariffs. While the RBI has done a good job managing inflation, it’s clear that food supply issues could throw a wrench into that. The banking sector is strong, but credit growth lags, though we’re hoping for a pick-up in the new year.

Finally, for investors, finding the sweet spot of risk and return is still the challenge. 2025 was full of surprises and 2026 might not be any different.

Gearing Up for 2026: Why Asset Allocation is Crucial

Looking ahead to 2026, predicting the market direction is no easy feat. But one thing is clear: nailing your asset allocation strategy is more important than ever.

- Debt Investments

Park 10-15% in debt amid uncertainties. Lower returns, but it provides cushion against market swings, particularly if you have upcoming expenses like buying a home or funding education.

- Precious Metals

Gold and silver should be considered more as a protective asset rather than a wealth-creating one. Aim 5-10% portfolio slice to dodge volatility.

- International Exposure

A 10-15% exposure in international markets spreads rupee risk, taps global growth. It's crucial to spread investments across different countries and sectors—don't put all in one basket.

Stay diversified: Balance equities, bonds, metals and global assets to handle surprises like those seen in 2025. Stay proactive, stay prepared and let your investments work for you in 2026!

Ready to Optimize Your Portfolio for 2026?

At Liquide, we specialize in crafting personalized investment strategies for high net-worth individuals. Whether you're looking to optimize your equity investments, explore precious metals or diversify into international markets, we’re here to guide you every step of the way.

Download the Liquide App now and get in touch with us to build a resilient, well-diversified portfolio designed for long-term wealth creation and steady growth in 2026 and beyond.

Wishing you a Happy New Year and a year ahead that’s steady, balanced and rewarding!