POST-MARKET SUMMARY 24 November 2023

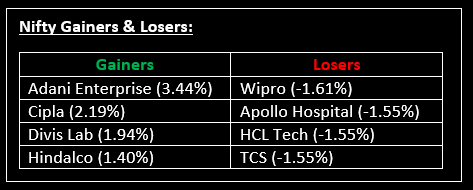

On November 24, benchmark indices closed with losses after a day marked by volatility. The Nifty has maintained its consolidation within the range of 19,620-19,875 for seven consecutive sessions. Top Gainer: Adani Enterprise | Top Loser: Wipro

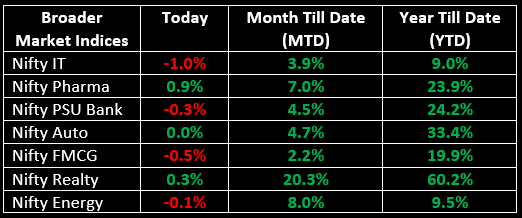

On November 24, benchmark indices closed with losses after a day marked by volatility. The Nifty has maintained its consolidation within the range of 19,620-19,875 for seven consecutive sessions. The IT sector fell the most, dropping by 0.97%, followed by FMCG and PSU Bank. On the positive side, Pharma emerged as the top gainer, posting a 0.87% rise, trailed by Metal and Healthcare.

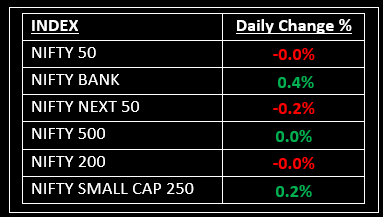

NIFTY: The index opened flat at 19,809 and made a high of 19,832 before closing at 19,794. Nifty has formed a small bearish candlestick pattern with upper & lower shadows on the daily chart. Its immediate resistance level is now placed at 19,850 while immediate support is at 19,750.

BANK NIFTY: The index opened 30 points higher at 43,607 and closed at 43,769. Bank Nifty has formed a bullish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 43,875 while support is at 43,500.

Stocks in Spotlight

▪ Gati: Stock surged over 4% after the company launched an advanced mega surface trans-shipment centre and distribution warehouse (STCDW) in Bengaluru.

▪ LIC: Stock jumped over 9% after the insurer said it had lined up three to four product launches in the coming months to achieve double-digit growth in new business premium in the current financial year.

▪ General Insurance: Stock surged 15% after AM Best assigned India National Scale Rating (NSR) to the company and upgraded the outlook to positive.

Global News

▪ Gold held its ground on Friday, on track to log its second consecutive weekly rise as analysts stepped up bets that the US Federal Reserve was done with interest rate hikes, sending the dollar lower.

▪ The dollar slipped on Friday, while the yen edged higher after Japan’s core consumer price growth picked up, reinforcing views that the Bank of Japan may soon roll back monetary stimulus.

▪ Brent crude futures rose in early Asian trade on Friday, reversing losses in the previous session as traders speculated on whether OPEC+ would come to an agreement on further production cuts.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.