POST-MARKET SUMMARY 23 August 2023

Post-market report and news around trending stocks.

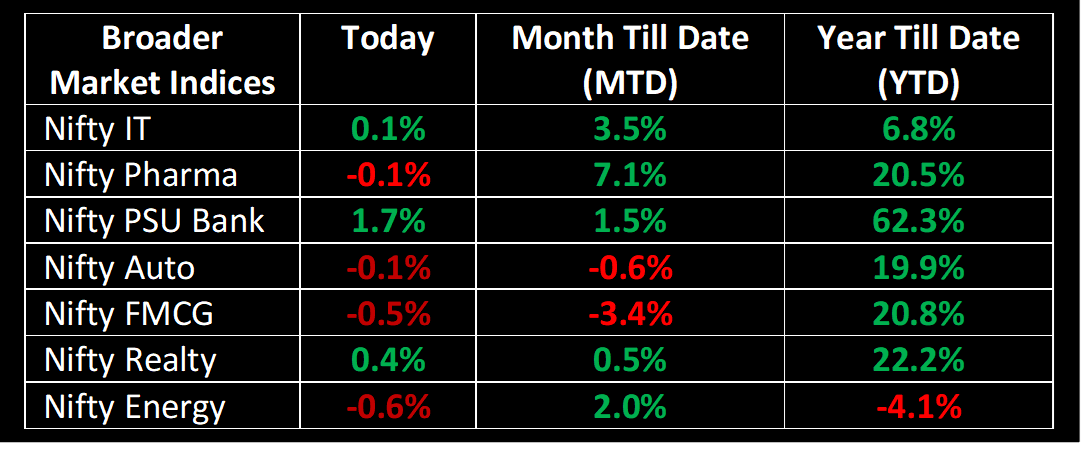

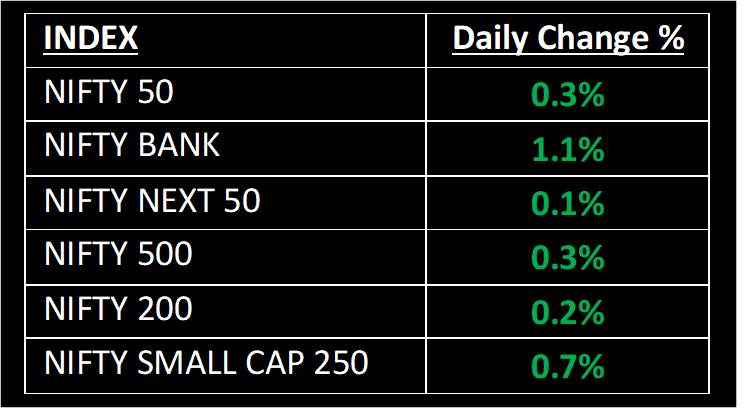

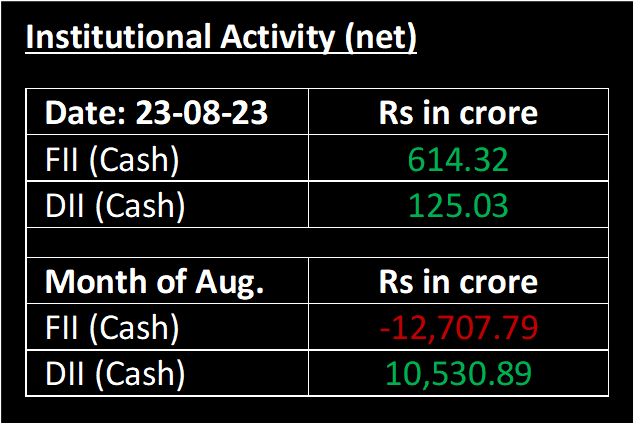

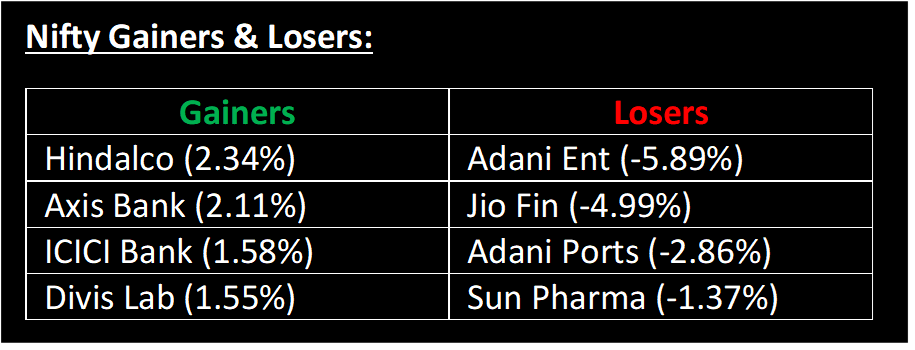

On August 23, the Nifty continued its upward trajectory for the third consecutive session, experiencing fluctuations in trade throughout the day before ending 48 points higher at 19,444. The market started on a flat note and traded in a narrow range through the first half. However, a surge in buying activity during the latter half of the day enabled the index to conclude near its highest point. The day was marked by significant volatility, with the banking, power, and metal sectors driving a rebound in prices.

NIFTY: The index opened 43 points higher at 19,439 and made a high of 19,472 before closing at 19,444. Nifty has formed a doji candlestick on the daily chart, as the closing was near the opening level. Its immediate resistance level is now placed at 19,500 while immediate support is at 19,300.

BANK NIFTY: The index opened 71 points higher at 44,064 and closed at 44,479. Bank Nifty has formed a long bullish candlestick on the daily scale. Its immediate resistance level is now placed at 44,680 while support is at 44,000.

Stocks in Spotlight

▪ Himadri Specialty Chemical Ltd: Stock gained over 3% after the company’s resolution plan along with Dalmia Bharat Refractories for Birla Tyres was given a go-ahead by the committee of creditors (CoC).

▪ Shriram Properties Ltd: Stock surged over 7% after foreign firm Omega TC Sabre Holdings Pte Ltd sold a further 2.29% stake, or 39 lakh shares, in the real estate developer.

▪ BEML: Stock gained nearly 4% to hit a 52-week high after the company bagged an order worth Rs 101 crore.

Global News

▪ Asia-Pacific markets were mixed on Wednesday as investors assess private business activity surveys from Australia and Japan, as well as inflation figures from Singapore.

▪ Gold prices gained on Wednesday after a slight pullback in US dollar and Treasury yields underpinned bullion above a key $1,900 level as investors await clues from major central bankers on the interest rate trajectory.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and / or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.